1. Set up a New Chart of Accounts Category:

- Go to the “Lists” menu in QuickBooks and select “Chart of Accounts.”

- Click the “New” button and select “Category.”

- Name the category “Cryptocurrency” or something similar.

2. Create a New Asset Account:

- Go back to the “Chart of Accounts” window and click the “New” button again.

- Select “Account” this time.

- Choose the “Asset” account type and name the account “Cryptocurrency Holdings.”

- Select the “Cryptocurrency” category you just created.

3. Classify Crypto Transactions:

- When recording cryptocurrency transactions in QuickBooks, use the “Cryptocurrency Holdings” account:

- For purchases: Credit “Cryptocurrency Holdings” and debit “Cash” or another expense account.

- For sales: Debit “Cryptocurrency Holdings” and credit “Cash” or another income account.

- For internal transfers between wallets: Debit and credit the “Cryptocurrency Holdings” account from different subaccounts.

4. Track Multiple Cryptocurrencies (Optional):

- If you manage multiple cryptocurrencies, you can create subaccounts within the “Cryptocurrency Holdings” account to track each currency separately. For example, you could have subaccounts for Bitcoin, Ethereum, and Litecoin.

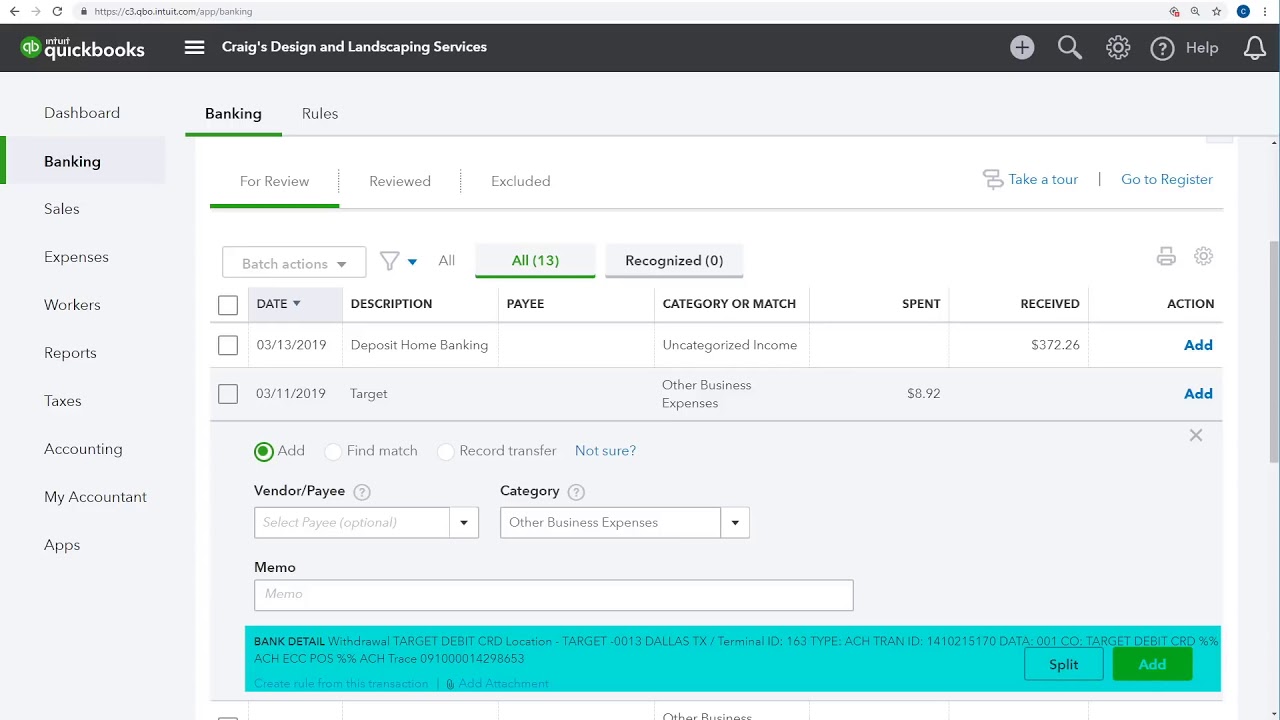

5. Use Memo Field for Transaction Info:

- In the memo field for each cryptocurrency transaction, include relevant information such as the amount in the originating wallet, the amount in the receiving wallet, the exchange rate, and any other relevant details.

Additional Tips:

- Consider using a third-party app that integrates with QuickBooks to enhance cryptocurrency tracking.

- Review your cryptocurrency transactions regularly to ensure accuracy and monitor your balances.

- Stay informed about tax regulations and accounting standards for cryptocurrency transactions.

Online casino & gambling reviews | Casinos Bonuses Online, Online Slot games, Gambling & Betting, phone Casino Best Related Posts:

- Crypto wallet | TopSlotSite.com… by Davi Boy Black December 15, 2022 slots Cacino.co.uk Web page ContentsIntroductionWhat is a Crypto Wallet and How Does it Work?What Are the Different Types of Crypto Wallets?How to Choose the Right Crypto Wallet for Your NeedsThe Pros and Cons of Using a…

- Crypto.com | TopSlotSite.com… by Davi Boy Black January 23, 2023 Slots Cacino.co.uk Web page ContentsIntroductionWhat is Crypto.com and How Does it Work?Exploring the Benefits of Investing in Crypto.comHow to Get Started with Crypto.comUnderstanding the Different Types of Cryptocurrencies Available on Crypto.comWhat Are the Risks Involved with…

- Hardware Wallets in Crypto |… by Davi Boy Black January 22, 2023 Slots Cacino.co.uk Web page ContentsIntroductionWhat is a Hardware Wallet and How Does it Work?What are the Benefits of Using a Hardware Wallet for Crypto?What are the Different Types of Hardware Wallets Available?How to Choose the Right…

- Bet To Me Crypto | by Davi Boy Black March 10, 2023 Casino Cacino.co.uk Betting, Online Gambling Reviews & News, Live Casino, Slots, blackjack roulette, Keno & ExtraIntroductionThe Rise of Bet To Me Crypto: A Comprehensive GuideWhy Bet To Me Crypto is the Future of Online BettingHow to…

- Crypto trading | TopSlotSite.com… by Davi Boy Black March 6, 2023 Slots Cacino.co.uk Web page ContentsIntroductionWhat is Crypto Trading and How Does it Work?What Are the Benefits of Crypto Trading?What Are the Risks of Crypto Trading?What Are the Different Types of Crypto Trading Strategies?How to Choose the…