Deposit Using phone Credit: A Comprehensive Guide

Depositing funds into an online account using phone credit is a convenient and accessible method that allows users to make payments directly from their mobile phones. This method is particularly advantageous for individuals who lack access to traditional banking services or prefer the convenience of using their mobile devices for financial transactions.

How Does Deposit Using Phone Credit Work?

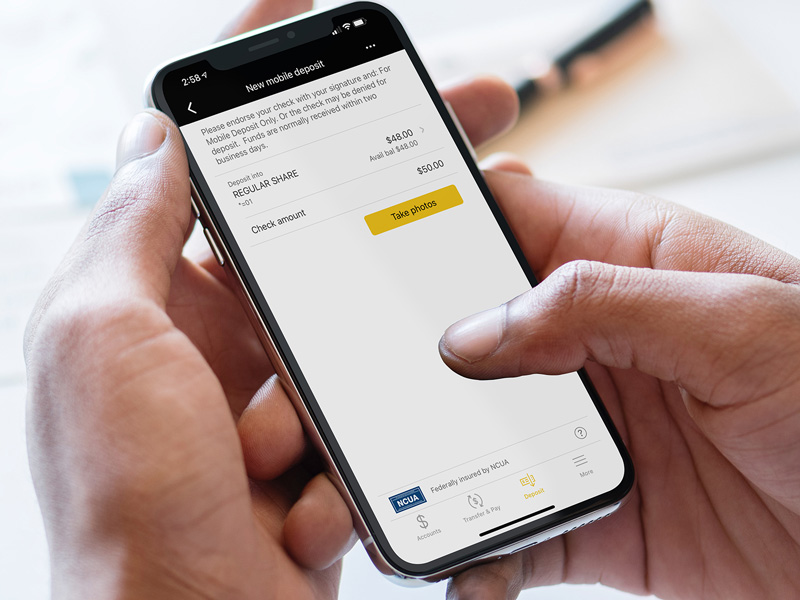

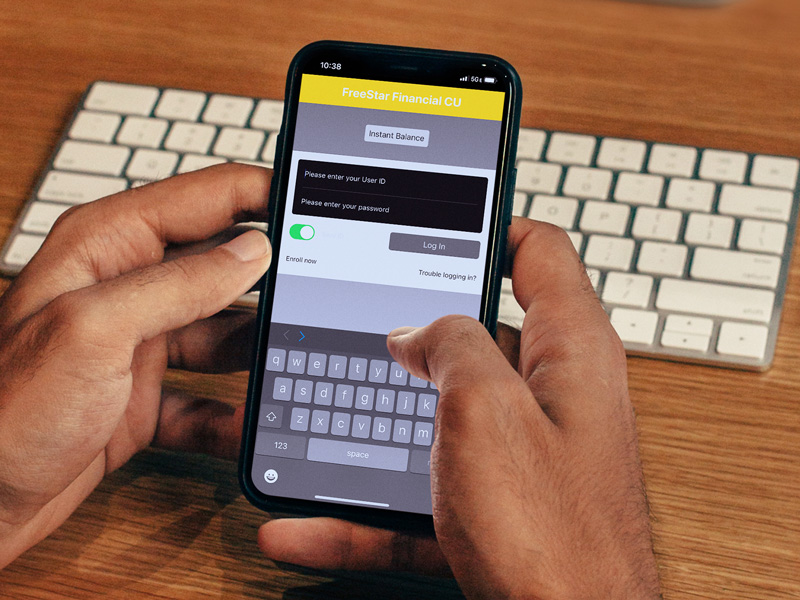

Initiate the Deposit Process:

- Log in to your account on the platform or website where you want to make the deposit.

- Navigate to the ‘Deposit' or ‘Add Funds' section.

Select Phone Credit as the Payment Method:

- Choose ‘Phone Credit' or ‘Mobile Payment' as the preferred deposit method from the available options.

Enter Your Phone Number:

- Provide your mobile phone number associated with the phone credit account you want to use.

- Ensure that the phone number is active and has sufficient credit balance to cover the deposit amount.

Verify Your Phone Number:

- To ensure the security of the transaction, a verification code is usually sent to your mobile phone.

- Enter the verification code in the designated field on the platform or website.

Specify the Deposit Amount:

- Input the amount you wish to deposit into your account.

- Consider any transaction fees or limits associated with the payment method.

Confirm the Transaction:

- Review the details of the deposit, including the amount, transaction fees, and expected processing time.

- Confirm the transaction by clicking the ‘Deposit' or ‘Confirm' button.

Authorization and Payment:

- Once confirmed, the platform or website will initiate the authorization process.

- The deposit amount will be deducted directly from your phone credit balance.

- Depending on the service provider and platform, the transaction may be completed instantly or within a short processing time.

Advantages of Depositing Using Phone Credit:

- Accessibility: Phone credit-based deposits are accessible to individuals who may not have access to traditional banking services or credit cards.

- Convenience: Users can conveniently make deposits directly from their mobile phones without the need for additional payment methods or bank transfers.

- Instant Processing: In many cases, deposits using phone credit are processed instantly, allowing users to access their funds immediately.

- Security: Phone credit-based deposits often involve verification processes to ensure the security of transactions and prevent unauthorized access.

- No Additional Fees: Depending on the platform or website, phone credit deposits may not incur additional transaction fees, making it a cost-effective method.

Limitations of Depositing Using Phone Credit:

- Deposit Limits: Platforms and service providers may impose deposit limits, restricting the maximum amount that can be deposited using phone credit.

- Transaction Fees: Some platforms or service providers may charge transaction fees for deposits made using phone credit.

- Compatibility: The availability of phone credit-based deposits may vary depending on the compatibility between your mobile network operator and the platform or website.

Overall, depositing using phone credit offers a convenient and accessible method for individuals to add funds to their online accounts. However, it's essential to consider any transaction fees, deposit limits, and compatibility issues associated with this payment method before proceeding with the transaction.# Deposit Using Phone Credit

Executive Summary

The rapid advancement and high adoption rate of mobile technology have brought about new payment methods. Apart from using traditional banking and e-wallet solutions, phone credit, i.e., the balance found on a prepaid SIM card, has emerged as a viable way to make payments online, thus widening the scope of e-commerce. This article explores the concept of making a phone credit deposit and guides readers on how to use their mobile balance to fund various transactions.

Introduction

To stay up-to-date with customers' evolving needs, payment providers are constantly exploring new avenues to enable clients to make seamless transactions. Phone credit deposit is one such method that has gained traction in recent years. This solution makes it easy for mobile subscribers to use their phone credit to make purchases online and pay for other services. Let's delve into this topic and understand how, when, and why individuals use it.

Understanding Phone Credit Deposits

Phone credit, often referred to as mobile credit, is a form of mobile payment where customers can pay for goods and services online or in physical stores without the need for a bank account or credit card. This service is most commonly offered by pre-paid mobile accounts. If you have an active SIM card and credit balance, you can use phone credit deposits to carry out several transactions.

Benefits of Using Phone Credit to Deposit Funds

1. Convenience and Accessibility:

- A significant benefit of utilizing phone credit for deposits is its widespread availability, with almost everyone owning a mobile phone.

- The growing number of online businesses accepting mobile payments reflects the convenience of using prepaid phone balances to make transactions.

2. Ease of Use:

- Utilizing a mobile device's built-in messaging capabilities, users can send a text message to a business, authorizing a payment from their carrier-assigned account.

- User-friendly interfaces and straightforward procedures make sending a text message to initiate a payment hassle-free.

3. Simple Budgeting:

- When using a mobile phone credit balance for purchases, you don't need to worry about overspending, as you can only utilize the amount available in your account.

- This feature enables you to exercise more control over your spending and stay within your financial limits.

4. No Interest or Overdraft Fees:

- Since phone credit deposits are not linked to any credit facilities, there are no concerns about high-interest rates or extra penalties for making payments.

- This advantage saves you from additional financial obligations and ensures you only pay for the amount of your purchase without accumulating debts.

5. Enhanced Security:

- Using phone credit deposits diminishes the risk of fraud since you do not disclose sensitive financial information, like bank account details or credit card numbers, to online merchants, lowering the potential threat of unauthorized access.

Conclusion

A phone credit deposit is a practical and secure solution for individuals looking to make online purchases without using traditional banking methods. With the surge in internet penetration, this service allows customers with limited or no access to alternative payment options to participate in e-commerce. The convenience of conducting phone credit deposits and the widespread mobile phone ownership make it an appealing choice for consumers.

Keyword Phrase Tags:

- phone credit deposit

- prepaid mobile accounts

- convenience and accessibility

- ease of use

- secure payment method